Old Free, Gary Youssef was welcomed back to Freemen’s, where he presented a series of financial education workshops to our Sixth Form students.

Gary Youssef was Head Boy at Freemen’s in 1991-1992 and shared several stories about his time at school with the students. Gary’s career journey began with his training as a lawyer after which he went on to work as a solicitor and then in Legal Recruitment. He is now a Chartered Financial Advisor and Director of GSQ Wealth.

Part of a wider programme of activities which prepares students for the next stage of their lives after Freemen’s, the financial workshops highlighted the importance of budgeting and gave useful advice on how students can best manage their money.

The sessions explored what a budget is, why budgeting is important, how to prioritise needs over wants, and how to deal with financial difficulties. Topics covered in the sessions included; debit cards, credit cards, arrears, interest rates, spending habits, what to do if you get into debt and a budgeting challenge for the students to take on.

Keen to give something back to the Freemen’s community, Gary has also written an article on the importance of financial education for young people, which you can read below.

Financial Education: An important life skill for young people

Gary Youssef – GSQ Wealth Limited

Helping young people learn how to manage money is one of the most vital life skills they need. It is an increasingly important area to address with 76% of teachers rating financial education as ‘extremely important’. (Your Money Matters: An evaluation, February 2020)

Highlighting how important financial education could be to society, is the statistic that 332 people a day were declared insolvent or bankrupt in England and Wales in January to March 2022 (equivalent to one person every 4 minutes 20 seconds) (The Money Charity, April 2022). The total unsecured debt per UK adult in February 2022 was £3,771 (The Money Charity, April 2022). These figures could potentially be reduced if more of us were given the life skills to manage our money at a younger age.

The key is not to spend money you have not got. Work out what your essential spending is i.e. expenses to meet your basic needs to live, such as grocery shopping, utility bills and rent and then set your discretionary spending limit i.e. on your ‘wants’, rather than ‘needs’, such as eating out, entertainment and holidays. Set yourself a budget and stick to it.

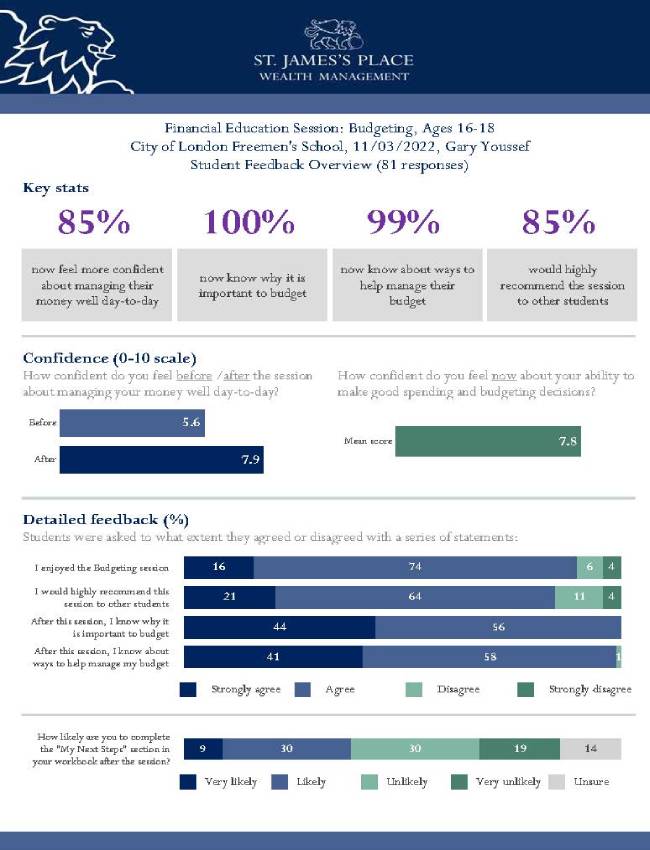

I delivered a financial education workshop to Sixth Formers at the school and I realised how eager the students were to understand more in this area. A survey of over 80 students found that, after participating in the workshop, 85% of them felt more confident about managing their money day-to-day and 99% of them felt better equipped to manage their budget going forward. Indeed 100% of the students suggested that, after having had the session, they now knew why it was important to budget. This can only be a positive for them as they embark on the next stage in their lives.

The students thirst for more knowledge in this area is underscored by the Young Persons’ Money Index in 2020-22 which found that in general 83% of students wanted more financial education in school, 67% of students worried about money and a significant number (75%) said most of their financial understanding came from their parents, rather than their school (just 8%).

Providing financial education for young people within schools can only be a good thing, particularly in light of the findings above and this knowledge will give them at least some of the life skills, to better manage their new found independence, once they leave behind the school gates.

GSQ Wealth Limited is an Appointed Representative of and represents only St. James's Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group's wealth management products and services, more details of which are set out on the group's website www.sjp.co.uk/products.

.jpg&command_2=resize&height_2=85)

.jpg&command_2=resize&height_2=85)